Statement on Quality Management Standards No. 1: A Firm’s System of Quality Management

August 27, 2024

By Ashley Baum, CPA, Mike Trafzger, CPA, and NCACPA’s A&A Resource Group

What is the statement and who does it affect?

In June 2022, the AICPA’s Auditing Standards Board and Accounting and Review Services Committee released four interrelated final standards on quality management, which are intended to improve a firm’s internal quality processes for audit and attest engagements. Included in these four standards is Statement on Quality Management Standards (SQMS) No. 1, A Firm’s System of Quality Management (SQMS No. 1). SQMS No. 1 supersedes Statement on Quality Control Standards (SQCS) No. 8, A Firm’s System of Quality Control (SQCS No. 8). The update to the AICPA professional standards from SQMS No. 1 includes a new section to the professional standards, referred to as QM sec. 10 (QM sec. 10). QM sec. 10 deals with a firm’s responsibilities to design, implement, and operate a system of quality management for its accounting and auditing practice.

Accounting firms that provide audit, review, and compilation services are subject to the standard, and are required to be in compliance by December 15, 2025. Early adoption is permitted if all standards on quality management are implemented at the same time.

What are the key changes?

- New risk-based approach, incorporating a risk assessment process driving firms to focus on quality management tailored to their circumstances

- Revised components of the system of quality management—two new components, including information and communication

- More robust leadership and governance requirements

- Enhanced monitoring and remediation processes

- New requirements for networks and service providers

What is a system of quality management (SQM)?

A SQM is defined as a system designed, implemented, and operated by a firm to provide the firm with reasonable assurance that:

- The firm and its personnel fulfill their responsibilities in accordance with professional standards and applicable legal and regulatory requirements, and conduct engagements in accordance with such standards and requirements; and

- Engagement reports issued by the firm are appropriate in the circumstances.

What is required by accounting firms?

Expectations will depend on the firm’s size, nature, and types of engagements they perform. The specific risk-based approach can be broken down into three steps:

- Establishing quality objectives. The firm is required to establish the quality objectives specified by SQMS No. 1 and any additional quality objectives considered necessary by the firm to achieve the objectives of the SQM.

- Identifying and assessing risks to the achievement of the quality objectives. The firm is required to identify and assess quality risks to provide a basis for the design and implementation of responses.

- Designing and implementing responses to address the quality risks. The nature, timing, and extent of the firm’s responses to address the quality risks are based on, and responsive to, the reasons for the assessments given to the quality risks.

The firm’s documentation of the SQM must be sufficient to enable the firm and its peer reviewer to monitor the design, implementation, and operation of the firm’s SQM.

At least annually, the individual(s) assigned ultimate accountability for the SQM should evaluate the SQM and conclude whether the SQM provides the firm with reasonable assurance that the objectives of the system are being achieved.

Does QM sec. 10 provide specific details about what the firm’s SQM should address?

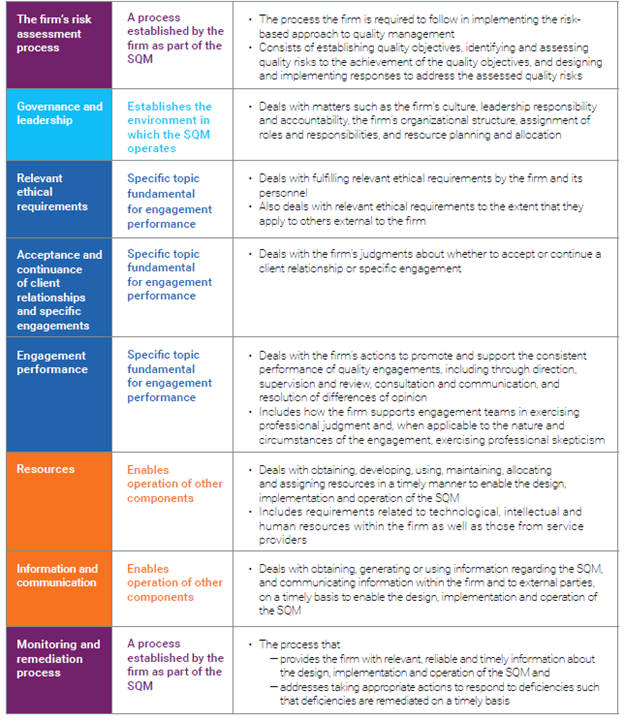

Yes. The SQM comprises of eight interrelated components as follows:

How can my firm prepare?

Although December 2025 can feel far away, it is important to start preparation now. The level of preparation for firms should vary based on the firm's size and the nature of their engagements. Larger firms will likely have more unusual risks and will need to identify the risks that apply to their industries or specific offices. Small firms may have fewer risks, but will still need to identify their responsible person and allocate time to incorporate the new standards to their SQM.

The AICPA has published a free, robust practice aid and tool to help firms and practitioners understand the requirements of SQMS No. 1. The practice aid is available in two versions: sole practitioners and small- and medium-sized firms. The interactive guide provides a streamlined approach, ensuring you’re well-prepared to meet the requirements of the SQM standards. The practice aid is intended to work in tandem with the AICPA’s Example Risk Assessment template, which provides a starting point for each component and library of quality risks and responses. Additionally, many firms that receive practice tools through service providers such as Thomson Reuters or Wolters Kluwer may have access to templates to help develop and document their firm’s specific SQM.

While QM sec. 10 provides new guidance, a firm’s SQM may be designed as an evolved system of quality control. Therefore, many firms may be able to use previous quality control documentation as a starting point in developing their SQMS No. 1-compliant SQM. Based on the quality risks identified during the risk assessment process, firms should map relevant risks to current controls—or, as SQMS No. 1 calls them, “responses to quality risks.” Identify quality risks without appropriate responses as well as any current responses that do not map to a quality risk. Then, design and implement new responses for those risks that are not addressed and consider eliminating or changing controls that are not responsive to quality risks.

As with any new standard, it is important for accounting firms to become familiar with the standard to make sure they are adequately prepared. Take advantage of the many free resources available to assist in adopting SQMS No. 1, and develop a timeline for implementation to ensure you are confident in your firm’s compliance at December 15, 2025.

Find more information on Quality Management here on the AICPA home page of peer review: https://us.aicpa.org/interestareas/peerreview

Reprinted with permission from the North Carolina Association of Certified Public Accountants

%2012.18.png)